|  ...THE

IMPACT ...THE

IMPACT

The success of GRP depended not only on the participation and

disclosure of data but also on industry paying heed to the rating and its recommendations.

Before the rating of pulp and paper sector began, despite developing a robust and

transparent model of GRP, CSE had doubts about the success of the project in India. Indian

industry was notorious for turning a near-deaf ear to regulations and regulators.

Therefore, it seemed unlikely that CSE’s GRP would prick the conscience of the

industry.

However, on all counts, CSE was in for a pleasant surprise. The

relevance of the entire exercise was realised in actual terms when a large section of the

pulp and paper industry, acknowledged and adopted many of the recommendations specifically

given to each company by the project.

|

| The project is using a discrepancy policy to penalise companies

who provide wrong information. |

|

|

Rating of the Pulp and Paper Sector

The sample All pulp and paper production plants with more than 100 tonnes per day (tpd)

production capacity were selected for the rating. The sample consisted of 28 production

units of 23 companies spread across 13 states.

The ratings Overall the sector had performed very poorly with only

2 companies getting 3 leaves award while 13 companies were in the two leaves category and

as many as 12 companies in one leaf category (see Table 1.1). Though the poor

performance of the pulp and paper industry was something that GRP expected from the very

beginning, the finding of the rating was totally unexpected and a true eye-opener.

indings In comparison to some industries like mining, which are

inherently unsustainable, because the natural resources they exploit are non-renewable,

the pulp and paper industry seems less environmentally damaging. In practice, however, the

project found out that the pulp and paper industry is a voracious consumer of natural

resources like water, wood fibre and energy and during production and disposal stages, a

large proportion of these come out in the form of waste. The project also found that the

sharp contrast between pulp and paper companies of India and that of developed world is

because of the use of obsolete technology and the small size and capacity of the Indian

mills. The major findings of pulp and paper sector rating is summarised below:

Name |

Installed

capacity

(in MT/annum) |

State |

Weighted

score (%) |

Ranking/Rating |

J K Paper Mills |

90,000 |

Orissa |

42.75 |

1 |

Andhra Pradesh

Paper Mills Ltd |

98,500 |

Andhra Pradesh |

38.50 |

2 |

Sinar Mas Pulp

& Paper (India) Ltd |

1,15,000 |

Maharashtra |

37.40 |

# |

BILT-Ballarpur Unit |

1,50,000 |

Maharashtra |

33.44 |

3 |

Hindustan Newsprint

Ltd |

1,00,000 |

Kerala |

33.30 |

4 |

SIV Industries Ltd |

60,000 |

Tamil Nadu |

31.73 |

5 |

Pudumjee Pulp &

Paper Mills Ltd |

33,000 |

Maharashtra |

31.44 |

6 |

Tamil Nadu

Newsprint & Papers Ltd |

1,80,000 |

Tamil Nadu |

31.40 |

7 |

ITC-Bhadrachalam

Paperboards Ltd |

62,500 |

Andhra Pradesh |

31.15 |

8 |

Century Pulp &

Paper |

Century Pulp &

Paper 1,51,920 |

Uttar Pradesh |

31.07 |

9 |

HPCL-Nagaon Paper

Mills |

1,00,000 |

Assam |

28.70 |

10 |

Seshasayee Paper

& Boards Ltd |

60,000 |

Tamil Nadu |

28.20 |

11 |

The West Coast

Paper Mills Ltd |

1,19,750 |

Karnataka |

27.67 |

12 |

BILT-Asthi Unit |

35,000 |

Maharashtra |

27.10 |

13 |

BILT-Yamunanagar

Unit |

70,000 |

Haryana |

25.70 |

14 |

The Central Pulp

Mills Ltd |

45,000 |

Gujarat |

25.35 |

15 |

Star Paper Mills

Ltd |

53,000 |

Uttar Pradesh |

24.76 |

16 |

Shree Vindhya Paper

Mills Ltd |

33,000 |

Maharashtra |

24.70 |

17 |

BILT-Sewa Unit |

30,000 |

Orissa |

23.75 |

18 |

Orient Paper Mills |

85,000 |

Madhya Pradesh |

22.10 |

19 |

The Mysore Paper

Mills Ltd |

1,30,000 |

Karnataka |

21.60 |

20 |

Cachar Paper Mills |

1,00,000 |

Assam |

21.43 |

21 |

Rama Newsprint

& Papers Ltd |

61,380 |

Gujarat |

21.10 |

22 |

BILT-Chaudwar Unit |

20,000 |

Orissa |

21.06 |

23 |

Nath Pulp &

Paper Mills Ltd |

41,750 |

Maharashtra |

20.80 |

24 |

Grasim Industries

Ltd (Mavoor) |

57,600 |

Kerala |

20.65 |

25 |

Mukerian Papers |

34,650 |

Punjab |

20.01 |

26 |

Amrit Paper |

26,400 |

Punjab |

19.01 |

27 |

#Sinar

Mas was operational since 1996-97 only and thus its environmental performance could not be

compared with that of other mills. |

A mill with a capacity of 33,000 tonnes

per annum (tpa) is considered to be large in India, compared to Brazil and Sweden where

the large mills have a capacity between 300,000 to one million tpa. This poses potential

financial problems for Indian companies for upgrading technology to reach international

standards environmentally. A mill with a capacity of 33,000 tonnes

per annum (tpa) is considered to be large in India, compared to Brazil and Sweden where

the large mills have a capacity between 300,000 to one million tpa. This poses potential

financial problems for Indian companies for upgrading technology to reach international

standards environmentally.

|

| The objective of GRP is not only to rate the

environmental performance but also recommend ways to improve performance |

|

|

The

potential use of wastepaper is evident from the fact that mills in South Korea and Taiwan

are entirely dependent on wastepaper as a raw material. About 12-13 million tonnes or 14

per cent of the world’s consumption of wastepaper is traded internationally, of which

50 per cent is provided by the US. In India, a majority of paper mills (63 per cent) use

wastepaper as a raw material. They account for 30 per cent of the paper manufactured in

the country. However, most of the wastepaper is imported from countries like USA as the

domestic recycling rate is very poor. The

potential use of wastepaper is evident from the fact that mills in South Korea and Taiwan

are entirely dependent on wastepaper as a raw material. About 12-13 million tonnes or 14

per cent of the world’s consumption of wastepaper is traded internationally, of which

50 per cent is provided by the US. In India, a majority of paper mills (63 per cent) use

wastepaper as a raw material. They account for 30 per cent of the paper manufactured in

the country. However, most of the wastepaper is imported from countries like USA as the

domestic recycling rate is very poor.

Majority

of Indian mills still use elemental chlorine for bleaching and that too in an extremely

inefficient manner. The organochlorine discharged due to chlorine bleaching process enters

the food chain and does not degrade easily. In India, not even one state pollution control

board has facilities to test organochlorine and in practice, this parameter has not been

used by them to monitor

industrial discharge. Very few companies have ever monitored organochlorine in their

wastewater. Majority

of Indian mills still use elemental chlorine for bleaching and that too in an extremely

inefficient manner. The organochlorine discharged due to chlorine bleaching process enters

the food chain and does not degrade easily. In India, not even one state pollution control

board has facilities to test organochlorine and in practice, this parameter has not been

used by them to monitor

industrial discharge. Very few companies have ever monitored organochlorine in their

wastewater.

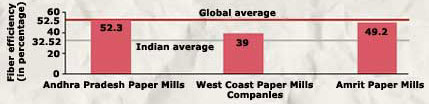

Fibre efficiency

While the Indian average in fibre efficiency is 32.4, the

world average is 52.5 per cent. Andhra Pradesh Paper Mills is only 0.2 per cent away from

meeting the world average |

|

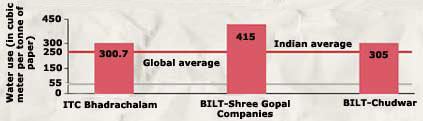

Water consumption

With 415 cubic metres (cum) requirement to make one tonne

of paper, Ballarpur Industries Ltd’s Shree Gopal unit is a class apart. The world

average is only 55 cum |

|

Fibre

requirements of the pulp and paper sector are met by bamboo, hard wood, agro waste and

wastepaper. The amount of land required by a mill to meet its raw material needs equals

the ecological burden that the mills fibre sourcing has on the environment. The average

Indian mills footprint is 2.17 hectare (ha) for every tonne of paper it produces. Taking

the total annual production to be around 3.2 million tonnes, the total land requirement of

the Indian pulp and paper sector would be 6.7 million ha. Fibre

requirements of the pulp and paper sector are met by bamboo, hard wood, agro waste and

wastepaper. The amount of land required by a mill to meet its raw material needs equals

the ecological burden that the mills fibre sourcing has on the environment. The average

Indian mills footprint is 2.17 hectare (ha) for every tonne of paper it produces. Taking

the total annual production to be around 3.2 million tonnes, the total land requirement of

the Indian pulp and paper sector would be 6.7 million ha.

There is a considerable dependence of Indian mills on government

forest as majority of the raw material are being outsourced from them. There is a considerable dependence of Indian mills on government

forest as majority of the raw material are being outsourced from them.

Water

comes extremely cheap to the Indian mills and therefore there is no attempt to regulate

its use. Hence Indian pulp and paper mills have very high water consumption. Water

comes extremely cheap to the Indian mills and therefore there is no attempt to regulate

its use. Hence Indian pulp and paper mills have very high water consumption.

|

![]()